Notes from My MBA

A takeaway or two from 21 classes at Booth.

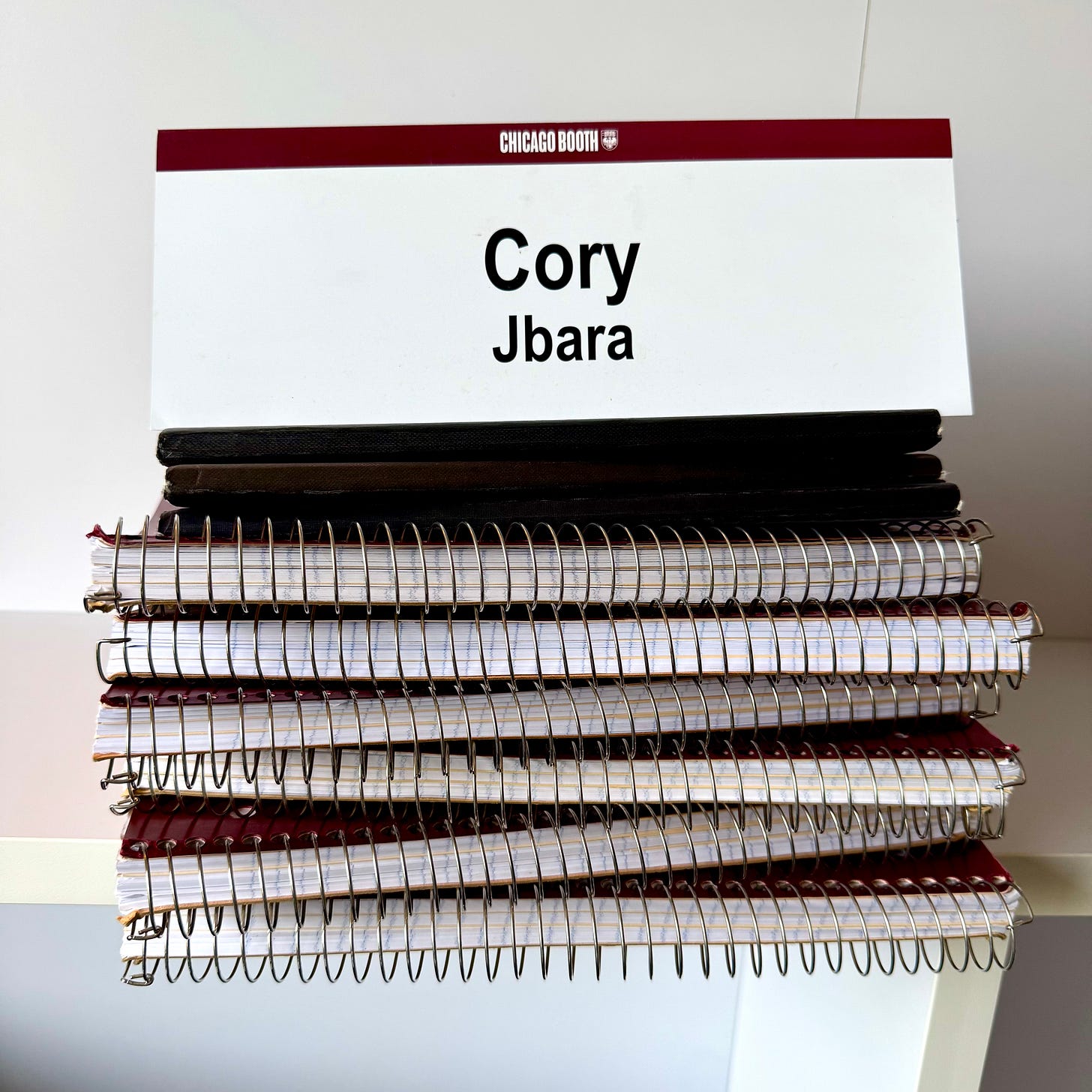

After coming down from the high of graduation this past weekend, I figured it would be a great time to look back at my old notebooks from my time at Booth (yes, I used physical notebooks the entire time). Flipping through put me back in the classroom, excited to learn and understand concepts from management, finance, strategy, entrepreneurship, and psychology.

While there was way too much content in those notebooks to possibly fit into an article, I hope these selected notes give you a fun glimpse into the classroom of my MBA program. Let’s dive in, class by class since 2020.

Business Statistics1

About 68% of data points lie within one standard deviation of the mean. 95% within two. 99% within three.

Goodhart’s Law: “When a measure becomes a target, it ceases to be a good measure.”

Microeconomics2

Prices act as signals of what to buy (demand) and what to produce (supply)

Think in terms of marginal costs and marginal benefits, not absolute.

It can become more efficient to produce at scale (economies of scale).

Financial Accounting3

Assets = Liabilities + Shareholder’s Equity

Gross Income = Revenue - COGS, Net Income = Revenue - Expenses

Marketing Strategy4

Building a brand is about consistency in positioning and frequency. The only reality that matters is the reality in the customer’s mind. “Consumers build an image of a brand in their minds in the same way a bird builds a nest: from the scraps and straws they chance upon.”

Focus on the benefits and value to the customer, as well as differentiation from the competition.

Investments5

In theory, a stock price is the time-discounted present value of all future dividends the company will pay out. In practice, it’s complicated.

Portfolio diversification is important to eliminate idiosyncratic risk.

Competitive Strategy6

Market forces in a competitive market move all profit to zero.

Two main competitive strategies: low cost or differentiation.

Network effects: the more people, the more valuable your product is.

Corporate Finance7

Cash flows all occur at different times. Money in the future is worth less than money now. You have to discount all cash flows back to the present to compare them properly (net present value, or NPV).

Cost of capital is the return investors need to justify doing a project. Cost of capital differs based on your capital structure (i.e. how much debt vs. equity you have on your balance sheet).

Accounting for Entrepreneurship: From Startup to IPO8

See my post on startup fundraising rounds for a more detailed overview. This class was amazing, I learned so much about the nuts and bolts of operating a startup.

Two ways to extend runway: raise more money or establish better cash management and operations.

Make sure you’re aligned with your investors and your board. Fill your board with those who can fill in the gaps of your knowledge.

Financial Statement Analysis9

People can shape financial statements to tell the story that they want of their business. Be sure to read them with a critical eye.

Managing the Workplace10

A benefit is only a good benefit if it is worth more to the employee than what you paid for it. E.g. healthcare gets better corporate rates.

People will do what they are incentivized to do. Build good incentives, and people will work hard to attain them.

Paying for performance (output) instead of time worked (input) will improve performance, but it will cost you more. However, it can also shift intrinsic motivation → extrinsic motivation over time.

New Venture Strategy11

“The world needs more entrepreneurs!” Doers will get farther than those on the sidelines.

All innovation comes from a struggling moment. Find people that are struggling and solve their problem. Most innovations come from anomalies.

Entrepreneurial Finance and Private Equity12

Look at the team (the jockey) and the startup (the horse).

Seed financing should be used to prove there is demand, prove there is a market, prove that you can operationalize the business.

Understand the exit opportunity before you start. Will you sell to a strategic acquirer, IPO, or sell to a PE firm?

Managing in Organizations13

“No matter what I think I just said, it is not what you just heard.” Be more abundantly clear than you thought you have to. What is in your mind did not get fully relayed to the other.

People are affected by the context they are in much more than we think.

Behavior = Personality * SituationAttitude change starts with behavior, not the other way around. Change behavior and model the behavior you want, then attitude will change. Fake it until you make it.

Entrepreneurial Selling14

Companies die because they don’t sell. Remember, products are bought, not sold.

Qualify your leads early and often. A quick NO is way better than a slow MAYBE.

Build your book of stories. Tell your company story as part of your sales pitch.

Mergers & Acquisition Strategy15

Diversification in portfolios is good, but diversification in corporate portfolios is bad. Focus on your core business and core competencies.

Never put your core business at risk. Change one variable at a time. Don’t bet the company.

Be able to firmly articulate your deal thesis.

Money & Banking16

Financial services power innovation. Financial services offer access to capital, and there is a supply and demand for this product.

Be deliberate about identifying your risks. Short-term vs. long-term risk. Understand interest rate exposure. Understand diversification + idiosyncratic risk.

Commercializing Innovation17

Build a unit model to prove out the concept, then replicate that unit at scale.

Validate your assumptions with real-world analogs. The more you are able to validate, the less risk you take as a new company.

Negotiations18

Your most powerful bargaining chip is your best alternative option (best alternative to a negotiated agreement, or BATNA). Do more research and find more alternative options, and your negotiating power will go up.

Anchor high, anchor early. The more research you do, the better you will be able to anchor your first offer.

Internal Information for Strategic Decisions19

Understand your costs, and you will understand your business. Allocate specific costs to specific actions to be able to make the best decisions. Determine your costs to determine your pricing.

Designing a Good Life20

Fundamental psychological goals include relatedness (social connection/belonging), competence (effective agency), and autonomy (self-determination).

Being more prosocial will increase happiness on average. We always believe socializing will be worse than we think, but it improves our mood, health, and life. Prosociality is contagious, and can change our lives and the lives of others over time.

Happiness is like a leaky tire, you have to fill it with a little bit of air every day. Frequency of small joys, not intensity of big joys.

Corporate Governance21

Nothing will change until something bad happens.

If you can’t put it on 1 page, you can’t explain it.

Understand your core competency, and leverage it as much as you can.

Culture eats strategy for breakfast.

There you have it! Five years of classes summed up in one article. While there was a lot more content I could have included (these notebooks are dense), I plan to look back on these selected takeaways often.

Getting my MBA has changed my perspective. I always had thoughts about business ideas, but now I have a framework for validating them. And while I learned so much in the classroom, the real value of my MBA is in the synthesis of these ideas. Being able to have a foundational understanding and be able to look at business challenges differently. Creatively applying the ideas above to new ventures and challenges. I am eternally grateful for my time at Booth, and I am looking forward to applying these learnings for the rest of my life.

Until next week,

Cory

Quarter: Spring 2020, Professor: Bryon Aragam

Summer 2020, Ram Shivakumar

Fall 2020, Joao Granja

Winter 2021, Christopher Krohn

Spring 2021, Niels Gormsen

Fall 2021, Chad Syverson

Fall 2021, Bruce Carlin

Winter 2022, Ira Weiss

Winter 2022, Michael Minnis

Spring 2022, Canice Prendergast

Fall 2022, Greg Bunch

Fall 2022, Steven Kaplan

Winter 2023, Ed O’Brien

Spring 2023, Michael Alter

Fall 2023, Stephen Morrissette

Spring 2024, Randall Kroszner

Fall 2024, Scott Meadow

Fall 2024, Joshua Dean

Winter 2025, Anna Costello

Winter 2025, Nicholas Epley

Winter 2025, Dennis Chookaszian

Cory, I think we owe you a fee!!! Really great summation!!